EVENT

Some places available!!

ARKWOOD WEALTH MANAGEMENT TRAINING DAY OF JUNE 24, 2016

Wealth Management Seminar

The Wealth Management Training Day is an event organized by Arkwood once a year, in June. Our team will take this opportunity to highlight various news and insight related to the Wealth Management industry with panelists around the world (lawyers, notaries, etc.).

The workshops are organized around technical presentations, practical feedback and case studies. The foreign countries represented depend on the topics discussed.

All the workshops will be held in French (except the speeches of Inbal Faibish Wassmer and Matthew Ledvina which will be in English). Questions could be asked in French.

Speakers

France

Stephanie Auferil, Arkwood SCP

Marine Dupas, Arkwood SCP

Michael Khayat, Arkwood SCP

Julien Riahi, Arkwood SCP

Delphine Eskenazi, Libra Avocats

Caroline Emerique-Gaucher, notaire, étude Morin & Lecoeur

Israël: Inbal Faibish Wassmer, ROSAK (Rosenberg Abramovich Schneller, Advocates)

Espagne: Fabricio Gonzalez, Anaford AG

USA: Matthew Ledvina, Anaford AG

UK: Caroline Cohen, The French Law Practice

Belgique: Benoit Philippart de Foy, Joyn Legal

Emirats Arabes Unis: Sophia Yazane et Mathieu Daguerre, M Advocates of Law

Program

8:30 – 9:00 Welcome breakfast

9:00 – 10:00 Wealth Management hot topics: World Tour and focus on France, Belgium, Switzerland, UK, Spain, LATAM, US, Israel and United Arab Emirates.

This session will provide an opportunity to comment on the most significant evolutions in the legal and tax environment relating to private clients and to analyze the Wealth Management Industry’s trends.

10:00 – 11:00 French residents mobility (Part I): Pre-immigration planning

French residents remain mobile, and tax considerations are no longer necessarily the reason for relocation.

In specific circumstances where parents, children, grandchildren and assets are located in different jurisdictions, it is of essence to carefully prepare the relocation regarding tax, marital and inheritance issues.

The panel of speakers, composed of Arkwood’s partners, Delphine Eskenazi (divorde lawyer) and Caroline Gaucher (notary), will present the available pre-immigration planning toolbox, and highlight some practical solutions. The French-US situation will be particularly focused on.

This workshop will also give the opportunity to share experiences between speakers and guests.

Topics: European Regulation on inheritance, matrimonial regimes strategies, gift and inheritance tax, estate planning, surviving spouse protection, matrimonial benefits, living wills…

11:00 – 11:30 Coffee break

11:30 – 12:30 French residents mobility (Part II): Planning in the host country

Opportunities and constraints in the host country must also be taken into account in the relocation planning.

Our panel, composed of Arkwood foreign correspondents, will emphasize the main tax regimes available in their jurisdictions and the most efficient available strategies. This workshop will be organized around immigration planning case studies for French clients to the UK, US, Spain, Israel and United Arab Emirates.

Topics: optimization of the non-domiciled resident status (UK), treatment of EU holdings regarding PFIC, CFC regimes (US), Spanish holding regime, “Olé Hadash” regime (Israel)…

12:30 – 14:00 Lunch in the garden, weather permitting

14:00 – 15:30 Cross-border inheritance and tax planning: Life insurance at all costs?

Famous tool in France, life insurance could be inefficient in foreign countries and require some adjustments. As a continuation to the previous sessions, this workshop will be focused on strategies involving life insurance for French people in foreign countries.

Through case studies, the workshop composed of Arkwood’s partners and foreign correspondents will detail issues and opportunities between France, Luxembourg, US, UK and Belgium.

Topics: Recognition of Luxembourg life insurance in US and pre-departure planning, life insurance planning tool for non-domiciled residents UK, French-Belgian estate planning strategies towards French resident children.

15:30 – 16:00 Coffee break

16:00 – 17:00 Criminalisation of tax law

The border between tax optimization, abuse of law and tax fraud becomes more and more blurred in France. The use of foreign structures or trusts by French residents increases the risks of the strategies developed to be challenged. The tools for investigation and fight against tax fraud, available to the French tax administration are increasingly close to the criminal sphere; the strategies of the administration to get information also evolve…

Our team will review the last French tax audits and the criminal proceedings related to cross-border transactions, whereas our foreign correspondents will share their experience regarding the positions of their own tax authorities of certain transactions in their jurisdiction.

Topics: Abuse of law, criminal offence of tax fraud, laundering, control and investigation tools, criminal and tax procedure, origin of the information, use of media, trusts, holdings, substance…

17:00 – 17:30 Wrap-up session

17:30 – 18:30 Cocktail in the garden, weather permitting

From 8:30 to 5:30

Limited number of places!

Registration fee 420€ VAT incl. /pers (350€ VAT excl.)

Group registration fee: 360€ VAT incl./pers (300€ VAT excl.)

16% paid back to La Maison de la Recherche

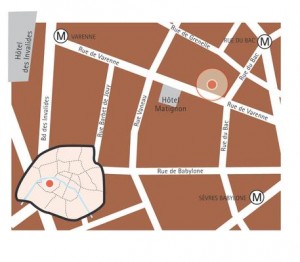

VENUE

La Maison de La Recherche

54 rue de Varenne

75007 Paris

Tel: +33 1 85 09 91 30

Fax: +33 1 85 09 92 30

contact@arkwood.fr